You are currently browsing the category archive for the ‘General Consumer Info’ category.

A record 20,782 real estate transactions were recorded in 2015 for Franklin county in the state of Ohio. Central Ohio market has fully rebounded from real estate crash of 2007-2009. Columbus Business First – Record 2015

Over the years, I’ve really been impressed with my client’s “home makeovers”. The last few years have been an excellent market for buyer’s to buy at extremely low prices.

Below are a few “before” and “after” photos of some recent client’s home makeovers. The Buyer’s did almost all the work themselves, along with a little help from their families and friends.

I would say, “move over Ty Pennington you might have some competition!”

Kitchen Makeover – Before & After!

A kitchen remodel can bring some good returns when you go to sell. The only problem is that they can be very costly, unless you do a lot of the work yourself. A client in Powell, Ohio did this excellent kitchen makeover. Beautiful job, Scott!

Laundry Room – Before & After!

Bedroom – Before & After!

Living Room – Before & After!

Dining Room – Before & After!

Kitchen – Before & After!

An incredible home makeover in the Hilliard area, this client did a wonderful job on their HUD foreclosure purchase. I’m always amazed how much you can totally transform a home with just new flooring/carpeting, painting and cleaning. Incredible job, Jason & Liz! You have a beautiful home!

Since 2007, the HomeBuyer’s Advocate blog has been featured in “This Old House” magazine and the Columbus Dispatch with 100+ posts and 54,000+ views! The HomeBuyer’s Advocate blog has been a leading resource for home buyers and homeowners in Columbus, Ohio. The HomeBuyer’s Advocate blog has been true to the blog mission statement “real opinions & quick, valuable information for the homebuyer in central Ohio.”

For additional information, we now have a great compliment to The HomeBuyer’s Advocate blog. Check out our company Facebook fan page to stay updated with the latest important news for home owners in central Ohio. Our fan page is loaded with great information, coupons, monthly Lowe’s gift card raffles, contests with prizes and funny home pictures and videos. Make sure you click to “Like”.

Buyer’s Resource Facebook Fan Page!

In January, we will be celebrating the new year (2K11) and reaching 200 Facebook fans with a special, incredible gift card raffle. Check us out and make sure you don’t miss out on this special prize. We are NOT your typical traditional real estate Facebook fan page.

Good luck out there!

Representing People, NOT Property!

The title tells you everything you need to know! A very good video for home buyers from “The Balancing Act” show on cable channel “Lifetime”. The National Association Exclusive Buyer’s Agents (NAEBA) is an organization that strives to give today’s home-buying consumers the level of service they deserve and are increasingly demanding. NAEBA members firmly believe that home buyers have the same full and equal representation rights as sellers in any real estate transaction. We have NAEBA members throughout the world.

Exclusive Buyer Agents (EBA) are the guaranteed, highest and best representation possible for a home buyer. We help our Buyer Clients, “Locate, Evaluate and Negotiate!”

Great information for the home buyer.

Good luck out there!

Please feel free to contact me if you need help or have questions

Representing People, NOT Property!

The clock is ticking down for first time home buyers. You need to act NOW to make sure that you don’t miss out on the $8,000 from Uncle Sam.

The clock is ticking down for first time home buyers. You need to act NOW to make sure that you don’t miss out on the $8,000 from Uncle Sam.

Here is the fast, quick information you will need to see if you qualify for the $8,000 tax credit for first-time home buyers from The American Recovery and Reinvestment Act of 2009.

- You must be a first time home buyer, defined as not owning a home in the past 3 tax years.

- Tax credit amount is 10% of the sales price of the home up to a maximum of $8,000.

- There is NO price limit on the sales price of home.

- Maximum income to receive FULL tax credit is $75,000 for a single person, the limit for married couples is $150,000.

- You can receive a PARTIAL tax credit for income levels up to $95,000 for a single person and $170,000 for married couples.

- There is no payback or penalty as long as you stay in home as your principal residence for 3 years.

- You must CLOSE on your new home on or after January 1, 2009 or before December 1, 2009.

***IMPORTANT: Congress passes tax credit extension. Must have binding sales contract dated on or before April 30, 2010 and close on or before June 30th, 2010.

This is the quick & dirty information that you need right now for the $8,000 Tax credit. For more detailed information you can go HERE.

It is a great time to be a home buyer. This is the perfect time to by a home, especially 1st time home buyers, as long as your job is secure. If you feel safe in your current employment/job, then there are just so many positive reasons to now buy a home. Don’t miss the “gravy train!”

-

Buyer’s market

-

Really low mortgage interest rates

-

High inventory levels. Plenty of home options

-

Depressed, low prices (buy low, sell high)

Please contact me if you have more questions or need help.

IMPORTANT: I’m just trying to help the “average Joe home owner” to understand the new $8,000 tax credit. I have to put this” CYA” disclaimer in my post. Please consult a tax professional or accountant for more details and eligibility questions regarding the $8,000 1st time home owner tax credit. I’m not an accountant or tax professional.

Good luck out there!

Great article in this past Sundays, The Columbus Dispatch newspaper about home inspections. “Inspector aims to open eyes”. Local home inspector, David Tamny of Professional Property Inspections will be the new president of the American Society of Home Inspectors (ASHI).

David has been a home inspector on our company approved list for nearly 13 years. His company web site is also on my blog roll link on left. David is a very competent home inspector.

Suprisingly, home inspectors in the state of Ohio are still not licensed. Home buyers have to be very careful when selecting a qualified home inspector. A good option for home buyers to find a qualified home inspector is to check and see if the inspector is a member in good standing with one of the two big professional trade associations.

National Associaton of Home Inspectors (NAHI) and American Society of Home Inspectors (ASHI) are the two largest home inspector trade associations in the United States. David Tamny will be the new incoming president of the 5,800+ member AHSI.

Make sure you take a second to read the article link on home inspections. It is great information for possible home buyers.

Please feel free to contact me if you need help or have questions

Another new home builder in the Central Ohio area has called it quits. On Tuesday, Joshua Homes unexpectedly shut down its web site and disconnected their phones. Joshua Homes appears to be the latest, in a long list, of new home builder casualties in our market. In the past few  years Central Ohio area has lost many new home builders:

years Central Ohio area has lost many new home builders:

- Toll Brothers

- Joshua Homes

- Centex Homes

- CV Perry

- Beazer

Many current Joshua home owners are very concerned about their new home warranties. This latest new build casualty really magnifies the potential problem of new home warranties. Joshua Homes had one of the longest home warranties (40 year) in our area. But, a warranty is only as good as the builder or warranty company. Does it really matter if you have a 40, 45 or even 50 year new home warranty if your builder is out of business in a few years?

The home buying consumer needs to realize that new home builder warranties are NOT regulated by any State agencies or the Department of Insurance. It is buyer beware! So, make sure you use an Exclusive (true) Buyer Broker when purchasing your next new home. An Exclusive Buyer Broker will protect you during your transaction and act as your advocate.

Good luck out there.

Representing People, NOT Property!

This is a follow up to my blog post on March 25th, “Toxic Drywall Could Be Largest Lawsuit In US History!” This blog post produced record high amount of views and comments. We really tapped into a very important topic for the consumer.

This is a follow up to my blog post on March 25th, “Toxic Drywall Could Be Largest Lawsuit In US History!” This blog post produced record high amount of views and comments. We really tapped into a very important topic for the consumer.

The good news is that the Columbus Dispatch is reporting that it appears there is NO Chinese drywall in the Columbus, Ohio area. The Columbus Dispatch did a thorough job of interviewing new home builders, home contractors, drywall suppliers and it appears that no toxic Chinese drywall made it to the Central Ohio area.

The Bad news is that the toxic Chinese drywall is definitely in the United States. In 2005, Chinese manufacturers shipped 500 million pounds  of drywall mainly to southern gulf coast states of Florida, Louisiana & Texas. Chinese drywall smells like “rotten eggs” and is being blamed for damaging furnaces and electrical wiring, tarnishing jewelry and possibly sickening families. So the potential is still there for toxic Chinese drywall to be the largest lawsuit in US history. Just be happy that it is not in our area.

of drywall mainly to southern gulf coast states of Florida, Louisiana & Texas. Chinese drywall smells like “rotten eggs” and is being blamed for damaging furnaces and electrical wiring, tarnishing jewelry and possibly sickening families. So the potential is still there for toxic Chinese drywall to be the largest lawsuit in US history. Just be happy that it is not in our area.

A good story on WSYX-ABC 6 – “Six On Your Side” about toxic drywall from China. M/I homes faces a lawsuit for possible toxic drywall. This has the potential to be a HUGE local and nationwide story.

A good story on WSYX-ABC 6 – “Six On Your Side” about toxic drywall from China. M/I homes faces a lawsuit for possible toxic drywall. This has the potential to be a HUGE local and nationwide story.

It seems like the story is really flying under the radar. I wonder why this isn’t getting more media/press coverage?

M/I Homes is the largest new home-builder in Central Ohio.

(Watch Consumer Alert Story)

This lawsuit has the potential to be the largest class action home defect lawsuit in US History!

Stay tuned for future updates and opinions in blog. A story this big could be a “game changer”!

Be careful out there.

Your home is probably your most valuable asset. You want to make sure your home is fully insured. But, you don’t want to be over-insured.

Many home owners don’t fully understand all the coverage options of their home owners’ insurance policy.

This blog post will give you 10 quick tips on how you can SAVE money on your home owners’ insurance premium.

- One insurer, multiple policies – It is best to have all your insurance policies (home, auto, boat, life, etc.) with one company. Almost all insurance companies will give their customers multi-policy discounts.

- Raise your deductible – You can possibly save between 12% – 37%, if you have a deductible of $500 to $5,000. You might not want to carry the same deductible amount for your auto and home owners policy.

- Newer is better – Home owners’ insurance premiums are less expensive for newer built homes. Older homes are typically more costly to rebuild and newer homes have safe, new mechanical systems. (electrical, heating, plumbing, etc.)

- Location, location, location – Do you live in earthquake prone California? Do you live in Florida where hurricanes are a fact of life? Other location issues to consider; are you close to a fire station?

- Insure the house, not the land – A fire and high winds will destroy your home, but not your land. Your land cost typically makes up 15% – 25% of your total home value.

- Don’t insure what you don’t have – Review your policy at least once a year. Make sure you aren’t over-insuring possessions (furs, computers, jewelry, guns, etc.). Also, pay close attention to endorsements on your policy. The amount of insurance protection that your receive per endorsement premium dollar is typically very costly.

- Better safe, than sorry – Smoke detectors, monitored security systems (fire/police), fire extinguishers, etc. can save you discounts from 5% – 20%.

- Where there is smoke, there is fire – More than 23,000 residential fires happen in the USA due to smoking issues. Some insurers offer discounts if all residents in home are non-smokers.

- Group discounts – Some insurers offer discounts to certain business or alumni associations. Make sure you ask your agent about this discount.

- Don’t jump around – If you are satisfied with your insurance company or agent then stay with that company. Most insurance companies offer discounts if you stay with them for 3, 5 and 10 years.

As always, you want to check with a licensed insurance agent before making any changes to your home owners’ insurance policy. I am NOT an insurance agent.

Special thanks to Stephen Evanko, Jr, Insurance Advisor and Author for reference material for this blog post.

Good luck out there!

This past Summer, Congress passed a $300 billion housing bill to rescue Freddie Mac and Fannie Mae and to help thousands of homeowners avert foreclosure.

The housing bill should definitely help the volatile housing and financing markets.

At the time, the housing bill was record breaking landmark legislation. But, Oh my how much has changed in 2008:

Largest US bank failure – Washington Mutual, $307 billion in assets.

Federal Reserve intervenes to save investment bank giant “Bear Stearns”. JP Morgan bank takes over Bear Stearns and receives $29 billion dollar loan from government.

IndyMac bank failure $32 billion in assets.

U.S. Government to take over failed AIG in $85 billion bailout.

In October, the new, largest government bailout in history to help US banks – $700 billion dollars.

There has been so much that has happened in the past 5-6 months that is easy to forget about one of the most beneficial aspects of the $300 billion bailout in July. The $7,500 tax credit is a great benefit for 1st time home buyers.

Here is everything you need to know:

Eligibility:

- Purchase a home between April 9, 2008 and June 30, 2009.

- Must be a first time homeowner or haven’t owned a home in the last 3 years.

- New home purchase must be your principle residence.

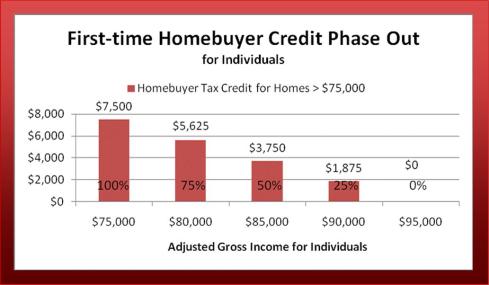

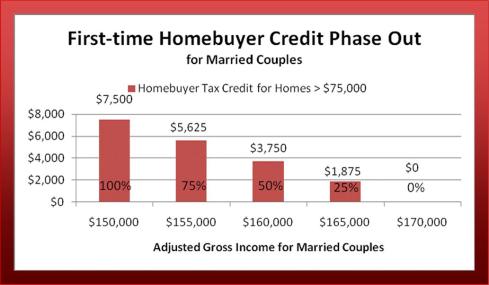

- Maximum income requirements (Adjusted Gross Income) for full $7500 tax credit benefit is $75,000 for individuals and $150,000 for married couples.

- Partial tax credit benefit eligible for adjusted gross incomes up to $95,000 for individuals and $170,000 for married couples (see phase out charts below)

Terms:

- $7,500 tax credit is basically an interest free loan from Uncle Sam.

- There is no application or approval process.

- If you are eligible, you simply claim the tax credit when you do your 2008 or 2009 taxes (IRS form 1040).

- Payment starts 2 years after you apply for the credit.

- Those qualifying for the full $7,500 tax credit will pay $500 once a year for 15 years.

- If you receive less than the full credit your payment schedule will be 6.67% per year over 15 years.

- Payment will be done via completing your federal tax return every year.

- You will owe nothing if you lose money on the sale of your home. Also, regardless of the sale price, you will never have to pay money “out of your pocket”. Here are 3 good examples that will better explain everything:

- Purchased a $200,000 home, sold 4 years later for $204,000. At time of sale you still owed $6,500 on tax credit. You would just have to pay $4,000. The remaining $2,500 would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $199,999. At time of sale you still owed $6,500 on tax credit. You lost money on your home purchase. The entire remaining $6,500 balance would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $225,000. At time of sale you still owed $6,500 on tax credit. You are responsible to pay the full $6,500 remaining balance.

Basic Q&A’s:

- Are there restrictions on the location of the property? Yes, property must be located in the United States. Property outside the US is not eligible for the tax credit.

- Are there restrictions related to the financing of the property? Yes, if your financing is obtained via a mortgage revenue bond (example; a tax exempt bond related program from a state housing agency) then you will NOT be eligible for tax credit.

- Are there any other types of financing restrictions? No, all types of mortgage finance programs are eligible. For example; Conventional, FHA, VA, cash, sub-prime (boo hiss), non-conforming, etc. Even cash purchases qualify as long as purchaser meets all other eligibility requirements listed above.

- Are there minimum or maximum home purchase prices? No, maximum home purchase price for tax credit. Homes purchased under $75,000 will only receive 10% tax credit. For example, Buyer purchases a $50,000 condo. The maximum tax credit will be $5,000.

- What types of housing qualifies for tax credit? All types of home ownership qualifies. For example, condos, co-ops, existing single family, new builds, manufactured homes, town homes, duplexes even houseboats!

- What happens if I sell my home within 15 years? You are not reading my post. You are just “skimming” the article. Review the last bullet point in terms section above.

I think the $7,500 tax credit is a great benefit for the first time homeowner. If you meet eligibility requirements then you should really take advantage of this tax credit.

But, some home owners would say “What’s the big deal? I still need to pay pay back the $7,500!” I would tell you there are 2 very important things to consider:

- Basic economic principle called the “time value of money”. Money now is more valuable than money in the future. This principle is especially true now in this bad economy. Cash is King!. So, I guess my bachelors degree in Finance from the great Ohio State University was worthwhile.

- A tax credit is more valuable than a tax deduction. A credit affects the tax amount you owe or refund amount dollar for dollar. A tax deduction just reduces your adjusted income that is taxable.

IMPORTANT: I’m just trying to help the “average Joe home owner” understand the $7,500 tax credit. I have to put this CYA disclaimer in my post. Please consult a tax professional for more details and eligibility questions regarding the $7,500 1st time home owner tax credit. I’m not an accountant or tax professional.

Good luck out there

Cool Comments!