You are currently browsing the category archive for the ‘Law’ category.

The other day I was attending a home inspection with one of my Buyer clients. The Home Inspector discovered some bugs that he thought were bed bugs. My Buyers asked me a good question, “Do Seller’s have to disclose bed bugs to potential homebuyers?”

The other day I was attending a home inspection with one of my Buyer clients. The Home Inspector discovered some bugs that he thought were bed bugs. My Buyers asked me a good question, “Do Seller’s have to disclose bed bugs to potential homebuyers?”

Bed bugs are becoming a major problem everywhere in the United States. But, the bed bug problem is huge in the state of Ohio. CBS Evening News recently had a story of the “Top 15 Worst Cities For Bed Bugs!” The State of Ohio has 4 cities in the top 15. Eeek Gads!!!

The answer to this question above might not be as straight forward as you think.

In a residential real estate transaction most states do require a property disclosure form. But, many states, including Ohio, do not specifically address bed bugs in their disclosure form. In my opinion, the state of Ohio residential property disclosure form is inadequate and needs to be greatly improved.

In the State of Ohio we have a four page Residential Property Disclosure (RPD) Form. A Seller is required to disclose any material problems or defects on their property that has occurred over the past five years.

The definition of a “material defect” is any problem with a home that would affect a Buyer’s decision to purchase the home or affect the value of the property.

The State of Ohio RPD has 14 sections (A-N) that address such items as; structural, roof, water intrusion, mechanical, wood-boring insects, etc. But, there is no specific section for disclosing bed bugs. So, if there is no section in RPD do Sellers have to disclose?

I am not an attorney!!! But, if you are a Seller struggling with what to disclose then I would use common sense and follow these 2 steps:

- The best approach for any Seller is “when in doubt always disclose”. Many Sellers do the exact opposite and disclose nothing. Sellers don’t want to jeopardize selling their home. This is a huge, risky gamble for any Seller.

- Ask yourself, “would a reasonable person think the problem would affect the value?”. If the honest answer is yes, then disclose.

You would think it would be a “no brainer” on how to answer the question, “Do Seller’s have to disclose Bed Bugs?”.

Yes, Yes, Yes…..you should disclose to potential Buyers any TYPE of pest, insect or rodent infestation in your home. This is not just limited to termites, carpenter ants, bed bugs. But, also squirrels, rats, bats, etc.

This is not just limited to termites, carpenter ants, bed bugs. But, also squirrels, rats, bats, etc.

Any reasonable person would think that a bed bug infestation in their home would affect the value of the property.

So, in the State of Ohio, even though we don’t have a specific section in the RPD to disclose bed bugs, you would need to disclose under section N (Other Known Material Defects)

Real estate disclosure procedures vary greatly from state to state. If you have specific questions then you should contact an attorney, licensed real estate agent or your states division/department of real estate.

I really need to finish this post. Bed bugs are so creepy that my mind is playing tricks on me. As I’m writing this blog post, I’m itching everywhere. I hope this is not happening to you. LOL!

If you want a little giggle, then hover your cursor over the bed bug pics above.

Good luck out there! I hope this information is helpful.

Please feel free to contact me if you need help or have questions

Representing People, NOT Property!

This is a follow up to my blog post on March 25th, “Toxic Drywall Could Be Largest Lawsuit In US History!” This blog post produced record high amount of views and comments. We really tapped into a very important topic for the consumer.

This is a follow up to my blog post on March 25th, “Toxic Drywall Could Be Largest Lawsuit In US History!” This blog post produced record high amount of views and comments. We really tapped into a very important topic for the consumer.

The good news is that the Columbus Dispatch is reporting that it appears there is NO Chinese drywall in the Columbus, Ohio area. The Columbus Dispatch did a thorough job of interviewing new home builders, home contractors, drywall suppliers and it appears that no toxic Chinese drywall made it to the Central Ohio area.

The Bad news is that the toxic Chinese drywall is definitely in the United States. In 2005, Chinese manufacturers shipped 500 million pounds  of drywall mainly to southern gulf coast states of Florida, Louisiana & Texas. Chinese drywall smells like “rotten eggs” and is being blamed for damaging furnaces and electrical wiring, tarnishing jewelry and possibly sickening families. So the potential is still there for toxic Chinese drywall to be the largest lawsuit in US history. Just be happy that it is not in our area.

of drywall mainly to southern gulf coast states of Florida, Louisiana & Texas. Chinese drywall smells like “rotten eggs” and is being blamed for damaging furnaces and electrical wiring, tarnishing jewelry and possibly sickening families. So the potential is still there for toxic Chinese drywall to be the largest lawsuit in US history. Just be happy that it is not in our area.

A good story on WSYX-ABC 6 – “Six On Your Side” about toxic drywall from China. M/I homes faces a lawsuit for possible toxic drywall. This has the potential to be a HUGE local and nationwide story.

A good story on WSYX-ABC 6 – “Six On Your Side” about toxic drywall from China. M/I homes faces a lawsuit for possible toxic drywall. This has the potential to be a HUGE local and nationwide story.

It seems like the story is really flying under the radar. I wonder why this isn’t getting more media/press coverage?

M/I Homes is the largest new home-builder in Central Ohio.

(Watch Consumer Alert Story)

This lawsuit has the potential to be the largest class action home defect lawsuit in US History!

Stay tuned for future updates and opinions in blog. A story this big could be a “game changer”!

Be careful out there.

This past Summer, Congress passed a $300 billion housing bill to rescue Freddie Mac and Fannie Mae and to help thousands of homeowners avert foreclosure.

The housing bill should definitely help the volatile housing and financing markets.

At the time, the housing bill was record breaking landmark legislation. But, Oh my how much has changed in 2008:

Largest US bank failure – Washington Mutual, $307 billion in assets.

Federal Reserve intervenes to save investment bank giant “Bear Stearns”. JP Morgan bank takes over Bear Stearns and receives $29 billion dollar loan from government.

IndyMac bank failure $32 billion in assets.

U.S. Government to take over failed AIG in $85 billion bailout.

In October, the new, largest government bailout in history to help US banks – $700 billion dollars.

There has been so much that has happened in the past 5-6 months that is easy to forget about one of the most beneficial aspects of the $300 billion bailout in July. The $7,500 tax credit is a great benefit for 1st time home buyers.

Here is everything you need to know:

Eligibility:

- Purchase a home between April 9, 2008 and June 30, 2009.

- Must be a first time homeowner or haven’t owned a home in the last 3 years.

- New home purchase must be your principle residence.

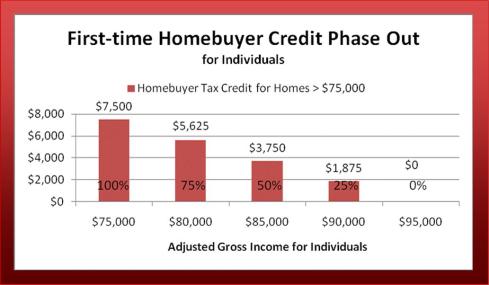

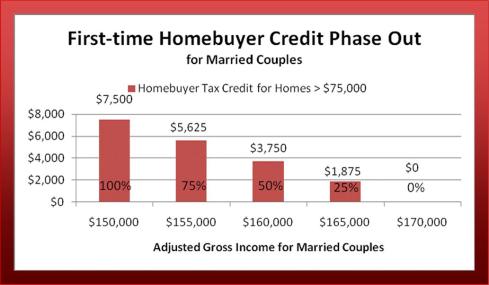

- Maximum income requirements (Adjusted Gross Income) for full $7500 tax credit benefit is $75,000 for individuals and $150,000 for married couples.

- Partial tax credit benefit eligible for adjusted gross incomes up to $95,000 for individuals and $170,000 for married couples (see phase out charts below)

Terms:

- $7,500 tax credit is basically an interest free loan from Uncle Sam.

- There is no application or approval process.

- If you are eligible, you simply claim the tax credit when you do your 2008 or 2009 taxes (IRS form 1040).

- Payment starts 2 years after you apply for the credit.

- Those qualifying for the full $7,500 tax credit will pay $500 once a year for 15 years.

- If you receive less than the full credit your payment schedule will be 6.67% per year over 15 years.

- Payment will be done via completing your federal tax return every year.

- You will owe nothing if you lose money on the sale of your home. Also, regardless of the sale price, you will never have to pay money “out of your pocket”. Here are 3 good examples that will better explain everything:

- Purchased a $200,000 home, sold 4 years later for $204,000. At time of sale you still owed $6,500 on tax credit. You would just have to pay $4,000. The remaining $2,500 would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $199,999. At time of sale you still owed $6,500 on tax credit. You lost money on your home purchase. The entire remaining $6,500 balance would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $225,000. At time of sale you still owed $6,500 on tax credit. You are responsible to pay the full $6,500 remaining balance.

Basic Q&A’s:

- Are there restrictions on the location of the property? Yes, property must be located in the United States. Property outside the US is not eligible for the tax credit.

- Are there restrictions related to the financing of the property? Yes, if your financing is obtained via a mortgage revenue bond (example; a tax exempt bond related program from a state housing agency) then you will NOT be eligible for tax credit.

- Are there any other types of financing restrictions? No, all types of mortgage finance programs are eligible. For example; Conventional, FHA, VA, cash, sub-prime (boo hiss), non-conforming, etc. Even cash purchases qualify as long as purchaser meets all other eligibility requirements listed above.

- Are there minimum or maximum home purchase prices? No, maximum home purchase price for tax credit. Homes purchased under $75,000 will only receive 10% tax credit. For example, Buyer purchases a $50,000 condo. The maximum tax credit will be $5,000.

- What types of housing qualifies for tax credit? All types of home ownership qualifies. For example, condos, co-ops, existing single family, new builds, manufactured homes, town homes, duplexes even houseboats!

- What happens if I sell my home within 15 years? You are not reading my post. You are just “skimming” the article. Review the last bullet point in terms section above.

I think the $7,500 tax credit is a great benefit for the first time homeowner. If you meet eligibility requirements then you should really take advantage of this tax credit.

But, some home owners would say “What’s the big deal? I still need to pay pay back the $7,500!” I would tell you there are 2 very important things to consider:

- Basic economic principle called the “time value of money”. Money now is more valuable than money in the future. This principle is especially true now in this bad economy. Cash is King!. So, I guess my bachelors degree in Finance from the great Ohio State University was worthwhile.

- A tax credit is more valuable than a tax deduction. A credit affects the tax amount you owe or refund amount dollar for dollar. A tax deduction just reduces your adjusted income that is taxable.

IMPORTANT: I’m just trying to help the “average Joe home owner” understand the $7,500 tax credit. I have to put this CYA disclaimer in my post. Please consult a tax professional for more details and eligibility questions regarding the $7,500 1st time home owner tax credit. I’m not an accountant or tax professional.

Good luck out there

Last week there was a great article in the Columbus Dispatch newspaper, “Independent Title Agents Sue”. A group of small, independent title agents is petitioning the Ohio Supreme Court to STOP real estate brokers, banks, mortgage companies from steering business to affiliated title companies.

Last week there was a great article in the Columbus Dispatch newspaper, “Independent Title Agents Sue”. A group of small, independent title agents is petitioning the Ohio Supreme Court to STOP real estate brokers, banks, mortgage companies from steering business to affiliated title companies.

In a nutshell, the independent title agents are suing the Ohio Department of Insurance for failure to protect the consumer and to enforce state laws against what it calls “the spread of kickbacks and referral schemes in the real estate industry” (aka, affiliated business relationships).

Good news, Ohio law prohibits banks, real estate brokers and mortgage companies from being licensed title agencies. But, since 1974 the federal Real Estate Settlement Procedures Act (RESPA) has allowed affiliated business relationships. In my opinion, overall RESPA has been great legislation that has helped protect the consumer. But, RESPA really dropped the ball in regards to affiliated business relationships.

Let’s hope the independent title agents will be successful with their lawsuit. I will keep you updated with future blog posts. “Affiliated business relationships” are really bad for the consumer. These relationships raise the cost of many title company fees with no benefits to the consumer.

In my opinion, if this lawsuit wins it could really open an “ugly door” into our state departments and agencies that are set up to monitor and regulate many industries, such as real estate, lending, financial securities and insurance.

The “average Joe citizen” would think these agencies are set up to protect the consumer. But, in many times, the actions and decisions of these agencies have worked to protect the industry that they are monitoring more so than protecting the consumer.

We have been mixing “big business industry” with politics for years. This has fostered an environment of  “sleeping with the enemy” and/or “the fox is guarding the chicken coop”.

“sleeping with the enemy” and/or “the fox is guarding the chicken coop”.

This is a dangerous mix of power, control and greed that has been dormant for a long time. If this lawsuit is successful, hopefully it will expose other agencies and open up a lot more questions.

If you can’t tell by now, I am no proponent of “one stop shopping”. The problems of affiliated business agreements are just a smaller component of the entire “one stop shopping” farce.

There is only ONE reason why big banks, insurance companies and/or real estate firms offer you the convenience of one stop shopping and that is profit and greed. It will almost never be in your best interest to make a major financial decision on one stop shopping.

If you need to buy or sell a home in Central Ohio and you are thinking about using the largest real estate broker in our market to help with everything (real estate transaction, new loan, home warranty, title services, etc.) then you need to be really careful. As Dr. Phil would say, “You need to get REAL” (or not real, if you know what I mean).

You need to do research and work to be a smart, informed consumer. Shop around, make phone calls, get multiple estimates or quotes. If you do your research you will make the best informed decision and you will be better off financially.

In my opinion, there has always been a public perception that the real estate industry has been notorious for kickback schemes and unethical referral arrangements. Eliminating or better monitoring of affiliated business relationships/agreements will be a good start toward improving our public perception. Let’s hope the Ohio Supreme Court can do the right thing!

After we fix affiliated business relationships we will move onto stopping one stop shopping. heh, heh, heh!

Here are some related links:

Ohio Department of Commerce (Real Estate, Mortgage & Financial Securities)

Division of Financial Institutions

Be careful out there!

The volatile, toxic nature of manufacturing “meth” makes it a very serious health issue. For every pound of methamphetamine (crank) manufactured there is six pounds of toxic waste and residue left behind. In addition to the hazardous waste concerns, the making of “crank” in a drug lab is highly susceptible to explosions and fires. Trust me, you don’t want to be living in a former drug lab home or even near a drug lab. It is not going to be very good for your safety, home appreciation or resale value.

It would definitely be nice to make sure your new home wasn’t a former drug lab for Meth. The Drug Enforcement Agency (DEA) thinks the same way. This is why they have started the National Clandenstine Labortary Register, a great web site that will allow you to look up houses in your state that have been identified as meth labs.

The National Association of Realtors (NAR) is still trying to set guidelines & procedures on how to deal with drug lab homes. It seems NAR can’t figure out how to properly disclose drug homes and/or how to set standards for cleaning up drug homes. As of August 2008 NAR has no policy in place to deal with this issue.

So, take a second to review the registry to see if your new dream home was a former drug home. While your looking, you also might want to check other addresses of family members, friends, co-workers, etc. Lucky for us, it appears the higher concentration of drug homes are located in the southern states.

How Radon Gas Enters A Home!

We’ve had reason in recent days to re-investigate the risks of radon gas to our health. We got a lot of help from Elizabeth James, radon maven. [Thanks, Liz!]

The news is not good!

Radon, you will remember, is a colorless, odorless, tasteless, radioactive gas—the product of decomposing uranium deep in the earth.

Radioactive?

That can’t be good.

You’re right, it’s not.

According to the U. S. EPA online radon is a very serious threat to our health.

Radon is the number one cause of lung cancer among non-smokers, according to EPA estimates. Overall, radon is the second leading cause of lung cancer. Radon is responsible for about 21,000 lung cancer deaths every year. About 2,900 of these deaths occur among people who have never smoked. [emphasis mine, ed.]

It’s everywhere. But, mostly, it’s in your house!

A silent, invisible, odorless, tasteless, radioactive killer gas is sneaking into my home to give me cancer? R-I-G-H-T!

Sounds like another eco-maniacal greenie off the deep end doesn’t it?

It’s not.

(BTW, our sincerest apology to all ecologically concerned individuals whom we may have just offended. We’re just trying to drive home a point here—not make a political statement. Really.)

And there’s more bad news.

You are at a greater risk of dangerous exposure to this killer stuff here in central Ohio than most other places!

Uh Oh!

This is serious business, and you need to find out more about the risk to you and your family and what you can do about it.

Do it because there are reasonable ways to reduce exposure. Do it because you want to be here for your grandchildren. (Okay, here’s the real reason. Simon says “Do it.”)

The EPA has a free booklet available on line that provide excellent general information. There is an additional free publication that addresses the special concerns of those considering buying or selling a home.

Possibly the best source of good information about radon in the central Ohio area is our new friend Elizabeth

How We Are Exposed To Radon Gas!

James at the Ohio Department of Health. (You were wondering when we were going to get back to her, didn’t you? Thanks for staying with us.)

Call Liz at 800-523-4439 and ask her some questions about this stuff. She’s an expert. Find out how serious this really is…and what you can do about it.

Go ahead call her…she’s really nice.

Tell her we said “Hi”.

You smokers with children. [You know who you are.] Stop smoking now and call Liz. Your risk is like 100 times worse! No kidding. Do it right now.

(This health safety blog story was reproduced from the “Buyershome Journal” blog – July 31, 2007)

After years of failed attempts, it finally looks like we will have some licensing regulations in place for Home Inspectors in the State of Ohio by 2009. House bill (HB) 257 recently passed the Ohio House of Representatives by a wide margin (83-11). The bill will be reviewed by the Ohio Senate later this year when the legislature reconvenes after the November 4th election.

With all the problems in the last few years in real estate, it would be “political suicide” for any political official (wink, wink Gov. Ted Strickland) not to pass some positive legislation. Legislation designed to regulate & license Ohio’s home inspection industry is long over due.

For too long, any “Joe Schmoe” could print up a business card on their home computer and start a home inspection business. Because of this reason, there are inexperienced, unqualified inspectors in our area. This is a problem for a potential home buyer. The problems we have had in the home inspection industry are really “small potatoes” compared to all the other major problems in real estate (lenders, fraud, greed, non-disclosure, foreclosures, etc.). But, this is a good thing. This means legislation will probably get passed in the State of Ohio.

The new Home Inspection Licensing will probably include the following provisions:

1. Criminal penalties for performing home inspections without a license.

2. Creation of a process for investigating complaints filed against inspectors.

3. Creation of the Ohio Home Inspection Board to regulate the industry.

4. Creating minimum standards and guidelines for performing inspections.

Check out my previous past about “Home Inspection Nightmares”. This blog post also has good links to find qualified home inspectors in your area via The American Society of Home Inspectors (ASHI) and National Association of Home Inspectors (NAHI)

Good luck out there!

On Tuesday, February 19, 2008, a couple in Franklin County Court won a jury verdict against Maronda Homes for nearly 3.2 million dollars. The couple, Roman and Jennifer Cosner alleged that Maronda Homes knowingly sold them a defective home. The jury verdict in favor of the homeowners stated that Maronda Homes did sell a defective home and that Maronda was aware of that fact. Maronda acted in an “unfair, deceptive or unconscionable” manner.

On Tuesday, February 19, 2008, a couple in Franklin County Court won a jury verdict against Maronda Homes for nearly 3.2 million dollars. The couple, Roman and Jennifer Cosner alleged that Maronda Homes knowingly sold them a defective home. The jury verdict in favor of the homeowners stated that Maronda Homes did sell a defective home and that Maronda was aware of that fact. Maronda acted in an “unfair, deceptive or unconscionable” manner.

Maronda has always had a reputation for building the biggest square footage home possible at the lowest price. No other local production home builder can even come close to the price and square footage of Maronda Homes. There is usually a reason why this happens. It is not really complicated. Home owners should stop being so naive. You buy the lowest priced “anything” and you are going to have problems. I don’t care if you buying a new home, a  toilet seat or a widget. You get what you pay for!!!! Like many home builders, Maronda has had it’s fair share of unresolved consumer complaints.

toilet seat or a widget. You get what you pay for!!!! Like many home builders, Maronda has had it’s fair share of unresolved consumer complaints.

In my opinion, this could be landmark case for new home builders. The jury ruling in this case has now set a precedent for all future, similar cases. I would be really curious to see how this affects the policies and procedures of other builders in our area. I bet many builders are now “scrambling” to figure out how to adjust their business practices to deal with this jury verdict.

I’m glad the home owner had won their court case. But, I guarantee you, that they probably didn’t use an Exclusive Buyer Agent to help them purchase their new built home. If they had the proper Buyer Broker representation looking out for their best interest then this problem probably would not have happened. As consumers we have to be accountable for our bad decisions or lack of…..

Stay tuned for future posts on this topic.

HomeBuyer Advocate Mike

Representing People, NOT Property!

It has been a rough year for the real estate market & mortgage industry. But this week there was some good news, the US Congress extended legislation that makes mortgage insurance payments tax deductible until 2010. This legislation is one of the “bright spots” that will really help new and existing homebuyers for the next three years. Deducting the cost of mortgage insurance tax returns is expected to SAVE eligible borrowers $200 – $400 a year. The tax legislation, originally approved in December 2006, is basically the same expect for the three year extension. Borrowers whose annual adjusted gross income is $100,000 or less can fully deduct their mortgage insurance premiums from their 2007 – 2010 tax returns for homes purchased or refinanced during those time frames. Borrowers with incomes between $100,000 and $109,000 are eligible for a reduced tax break under the law. You can contact me if you further questions.

Below are some great links and a video that really help explain & understand mortgage insurance (MI) and last year’s tax legislation.

MarketWatch: Explaining The Tax Status of Mortgage Insurance

Wikipedia – Mortgage Insurance

News Story – One Step Closer To The American Dream!

Good Luck,

Cool Comments!