You are currently browsing the category archive for the ‘Finance’ category.

Good news, foreclosures in central Ohio fell drastically in 2013. In the eight county central Ohio region (Franklin, Delaware, Licking, Union, Fairfield, Pickaway, Madison and Knox counties) foreclosures are nearly 15% less than the previous year. Statewide foreclosures dropped 12 percent to the lowest level since 2006.

Good news, foreclosures in central Ohio fell drastically in 2013. In the eight county central Ohio region (Franklin, Delaware, Licking, Union, Fairfield, Pickaway, Madison and Knox counties) foreclosures are nearly 15% less than the previous year. Statewide foreclosures dropped 12 percent to the lowest level since 2006.

Columbus Dispatch Newspaper: http://www.dispatch.com/content/stories/business/2014/01/16/foreclosures-fall.html

Low foreclosure rates is great news. But, overall inventory levels are now really low. It looks like the upcoming Spring and Summer season will be a real estate market that will favor Sellers and not Buyers.

HomeBuyer Advocate Mike

Unless you’ve been living under a rock for the last year, many potential home buyers & sellers were aware of the great $8,000 tax credit for 1st time home buyers. But many consumers are not aware of all the other tax credit programs that are available:

Unless you’ve been living under a rock for the last year, many potential home buyers & sellers were aware of the great $8,000 tax credit for 1st time home buyers. But many consumers are not aware of all the other tax credit programs that are available:

- $8,000 tax credit for 1st time home buyers extended until April 30, 2010, must close by June 30th, 2010. Click HERE for more info.

- NEW-$6,500 tax credit for move up/repeat buyers. Existing home owners must have occupied their home for 5 years. Click HERE or contact me for more detailed info.

- $1,500 tax credit for energy efficiency updating for existing homes. Improvements must be completed by December 31, 2010. Most popular updates are: new furnace, central air, tankless water heaters, windows, doors, patio doors, water heaters, etc. Click HERE for completed list of eligible improvements and more info.

- State of Ohio Energy Efficient Appliance Rebate Program. Ohio residents can receive anywhere from $100 to $250 for EACH eligible appliance that they replace ($700 maximum). Program starts 1st quarter of 2010. This rebate program offers the perfect excuse to buy a new expensive front loading, super high-efficiency steam washer & dryer. Program ends when funds are depleted. Rebates will possibly only last 4-6 weeks. Important info: Ohio appliance rebate program, Ohio offers rebates for Energy efficient appliances, Rebate Program Outline

We hope this information can help save you some money. Please contact me if you have additional questions.

Disclaimer: Please consult a tax professional or accountant for additional details and eligibility questions regarding the federal tax credit programs. Thoroughly review all guideline requirements for energy-efficient home improvements or appliances before making the purchases.

Good luck out there.

Representing People, NOT Property!

The clock is ticking down for first time home buyers. You need to act NOW to make sure that you don’t miss out on the $8,000 from Uncle Sam.

The clock is ticking down for first time home buyers. You need to act NOW to make sure that you don’t miss out on the $8,000 from Uncle Sam.

Here is the fast, quick information you will need to see if you qualify for the $8,000 tax credit for first-time home buyers from The American Recovery and Reinvestment Act of 2009.

- You must be a first time home buyer, defined as not owning a home in the past 3 tax years.

- Tax credit amount is 10% of the sales price of the home up to a maximum of $8,000.

- There is NO price limit on the sales price of home.

- Maximum income to receive FULL tax credit is $75,000 for a single person, the limit for married couples is $150,000.

- You can receive a PARTIAL tax credit for income levels up to $95,000 for a single person and $170,000 for married couples.

- There is no payback or penalty as long as you stay in home as your principal residence for 3 years.

- You must CLOSE on your new home on or after January 1, 2009 or before December 1, 2009.

***IMPORTANT: Congress passes tax credit extension. Must have binding sales contract dated on or before April 30, 2010 and close on or before June 30th, 2010.

This is the quick & dirty information that you need right now for the $8,000 Tax credit. For more detailed information you can go HERE.

It is a great time to be a home buyer. This is the perfect time to by a home, especially 1st time home buyers, as long as your job is secure. If you feel safe in your current employment/job, then there are just so many positive reasons to now buy a home. Don’t miss the “gravy train!”

-

Buyer’s market

-

Really low mortgage interest rates

-

High inventory levels. Plenty of home options

-

Depressed, low prices (buy low, sell high)

Please contact me if you have more questions or need help.

IMPORTANT: I’m just trying to help the “average Joe home owner” to understand the new $8,000 tax credit. I have to put this” CYA” disclaimer in my post. Please consult a tax professional or accountant for more details and eligibility questions regarding the $8,000 1st time home owner tax credit. I’m not an accountant or tax professional.

Good luck out there!

This past Summer, Congress passed a $300 billion housing bill to rescue Freddie Mac and Fannie Mae and to help thousands of homeowners avert foreclosure.

The housing bill should definitely help the volatile housing and financing markets.

At the time, the housing bill was record breaking landmark legislation. But, Oh my how much has changed in 2008:

Largest US bank failure – Washington Mutual, $307 billion in assets.

Federal Reserve intervenes to save investment bank giant “Bear Stearns”. JP Morgan bank takes over Bear Stearns and receives $29 billion dollar loan from government.

IndyMac bank failure $32 billion in assets.

U.S. Government to take over failed AIG in $85 billion bailout.

In October, the new, largest government bailout in history to help US banks – $700 billion dollars.

There has been so much that has happened in the past 5-6 months that is easy to forget about one of the most beneficial aspects of the $300 billion bailout in July. The $7,500 tax credit is a great benefit for 1st time home buyers.

Here is everything you need to know:

Eligibility:

- Purchase a home between April 9, 2008 and June 30, 2009.

- Must be a first time homeowner or haven’t owned a home in the last 3 years.

- New home purchase must be your principle residence.

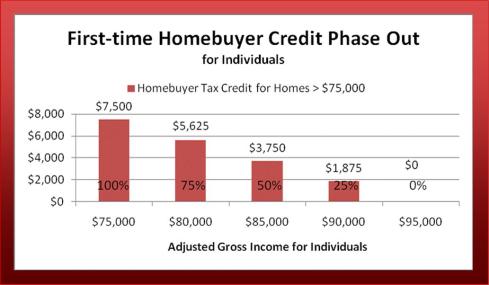

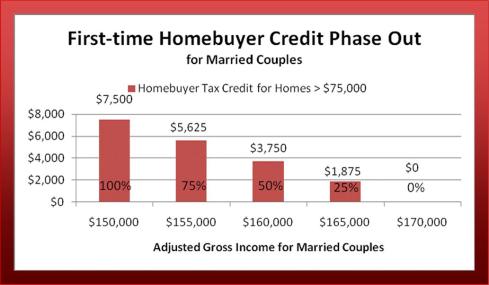

- Maximum income requirements (Adjusted Gross Income) for full $7500 tax credit benefit is $75,000 for individuals and $150,000 for married couples.

- Partial tax credit benefit eligible for adjusted gross incomes up to $95,000 for individuals and $170,000 for married couples (see phase out charts below)

Terms:

- $7,500 tax credit is basically an interest free loan from Uncle Sam.

- There is no application or approval process.

- If you are eligible, you simply claim the tax credit when you do your 2008 or 2009 taxes (IRS form 1040).

- Payment starts 2 years after you apply for the credit.

- Those qualifying for the full $7,500 tax credit will pay $500 once a year for 15 years.

- If you receive less than the full credit your payment schedule will be 6.67% per year over 15 years.

- Payment will be done via completing your federal tax return every year.

- You will owe nothing if you lose money on the sale of your home. Also, regardless of the sale price, you will never have to pay money “out of your pocket”. Here are 3 good examples that will better explain everything:

- Purchased a $200,000 home, sold 4 years later for $204,000. At time of sale you still owed $6,500 on tax credit. You would just have to pay $4,000. The remaining $2,500 would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $199,999. At time of sale you still owed $6,500 on tax credit. You lost money on your home purchase. The entire remaining $6,500 balance would be forgiven.

- Purchased a $200,000 home, sold 4 years later for $225,000. At time of sale you still owed $6,500 on tax credit. You are responsible to pay the full $6,500 remaining balance.

Basic Q&A’s:

- Are there restrictions on the location of the property? Yes, property must be located in the United States. Property outside the US is not eligible for the tax credit.

- Are there restrictions related to the financing of the property? Yes, if your financing is obtained via a mortgage revenue bond (example; a tax exempt bond related program from a state housing agency) then you will NOT be eligible for tax credit.

- Are there any other types of financing restrictions? No, all types of mortgage finance programs are eligible. For example; Conventional, FHA, VA, cash, sub-prime (boo hiss), non-conforming, etc. Even cash purchases qualify as long as purchaser meets all other eligibility requirements listed above.

- Are there minimum or maximum home purchase prices? No, maximum home purchase price for tax credit. Homes purchased under $75,000 will only receive 10% tax credit. For example, Buyer purchases a $50,000 condo. The maximum tax credit will be $5,000.

- What types of housing qualifies for tax credit? All types of home ownership qualifies. For example, condos, co-ops, existing single family, new builds, manufactured homes, town homes, duplexes even houseboats!

- What happens if I sell my home within 15 years? You are not reading my post. You are just “skimming” the article. Review the last bullet point in terms section above.

I think the $7,500 tax credit is a great benefit for the first time homeowner. If you meet eligibility requirements then you should really take advantage of this tax credit.

But, some home owners would say “What’s the big deal? I still need to pay pay back the $7,500!” I would tell you there are 2 very important things to consider:

- Basic economic principle called the “time value of money”. Money now is more valuable than money in the future. This principle is especially true now in this bad economy. Cash is King!. So, I guess my bachelors degree in Finance from the great Ohio State University was worthwhile.

- A tax credit is more valuable than a tax deduction. A credit affects the tax amount you owe or refund amount dollar for dollar. A tax deduction just reduces your adjusted income that is taxable.

IMPORTANT: I’m just trying to help the “average Joe home owner” understand the $7,500 tax credit. I have to put this CYA disclaimer in my post. Please consult a tax professional for more details and eligibility questions regarding the $7,500 1st time home owner tax credit. I’m not an accountant or tax professional.

Good luck out there

Last week there was a great article in the Columbus Dispatch newspaper, “Independent Title Agents Sue”. A group of small, independent title agents is petitioning the Ohio Supreme Court to STOP real estate brokers, banks, mortgage companies from steering business to affiliated title companies.

Last week there was a great article in the Columbus Dispatch newspaper, “Independent Title Agents Sue”. A group of small, independent title agents is petitioning the Ohio Supreme Court to STOP real estate brokers, banks, mortgage companies from steering business to affiliated title companies.

In a nutshell, the independent title agents are suing the Ohio Department of Insurance for failure to protect the consumer and to enforce state laws against what it calls “the spread of kickbacks and referral schemes in the real estate industry” (aka, affiliated business relationships).

Good news, Ohio law prohibits banks, real estate brokers and mortgage companies from being licensed title agencies. But, since 1974 the federal Real Estate Settlement Procedures Act (RESPA) has allowed affiliated business relationships. In my opinion, overall RESPA has been great legislation that has helped protect the consumer. But, RESPA really dropped the ball in regards to affiliated business relationships.

Let’s hope the independent title agents will be successful with their lawsuit. I will keep you updated with future blog posts. “Affiliated business relationships” are really bad for the consumer. These relationships raise the cost of many title company fees with no benefits to the consumer.

In my opinion, if this lawsuit wins it could really open an “ugly door” into our state departments and agencies that are set up to monitor and regulate many industries, such as real estate, lending, financial securities and insurance.

The “average Joe citizen” would think these agencies are set up to protect the consumer. But, in many times, the actions and decisions of these agencies have worked to protect the industry that they are monitoring more so than protecting the consumer.

We have been mixing “big business industry” with politics for years. This has fostered an environment of  “sleeping with the enemy” and/or “the fox is guarding the chicken coop”.

“sleeping with the enemy” and/or “the fox is guarding the chicken coop”.

This is a dangerous mix of power, control and greed that has been dormant for a long time. If this lawsuit is successful, hopefully it will expose other agencies and open up a lot more questions.

If you can’t tell by now, I am no proponent of “one stop shopping”. The problems of affiliated business agreements are just a smaller component of the entire “one stop shopping” farce.

There is only ONE reason why big banks, insurance companies and/or real estate firms offer you the convenience of one stop shopping and that is profit and greed. It will almost never be in your best interest to make a major financial decision on one stop shopping.

If you need to buy or sell a home in Central Ohio and you are thinking about using the largest real estate broker in our market to help with everything (real estate transaction, new loan, home warranty, title services, etc.) then you need to be really careful. As Dr. Phil would say, “You need to get REAL” (or not real, if you know what I mean).

You need to do research and work to be a smart, informed consumer. Shop around, make phone calls, get multiple estimates or quotes. If you do your research you will make the best informed decision and you will be better off financially.

In my opinion, there has always been a public perception that the real estate industry has been notorious for kickback schemes and unethical referral arrangements. Eliminating or better monitoring of affiliated business relationships/agreements will be a good start toward improving our public perception. Let’s hope the Ohio Supreme Court can do the right thing!

After we fix affiliated business relationships we will move onto stopping one stop shopping. heh, heh, heh!

Here are some related links:

Ohio Department of Commerce (Real Estate, Mortgage & Financial Securities)

Division of Financial Institutions

Be careful out there!

Even a small amount ($25, $50, $100) added to your mortgage payment each month when applied to the principal can have a significant impact on the total amount of interest you pay as well as how long you pay it.

For example, if you divide your monthly mortgage payment by 12 and add that amount to your monthly payment each month by the end of the year you will have paid the equivalent of an extra mortgage payment for the year—a 13th payment—all invested in principal reduction!

That 13th payment can make a big difference. For example, let’s say you borrowed $200,000 at 6.5 percent interest with a 30 year term. Your monthly payment would be a shade over $1,264 a month for principal and interest. By adding an extra $100 per month ($1,200 per year) you would pay off your mortgage in just over 23 years, knocking almost seven years off the loan and saving over $73,000 in interest.

Contact your lender to find out how they apply extra payment money from you. Some lenders may apply your extra money that you pay above your monthly payment amount automatically to your principal.

However some may appy it to your escrow account to pay taxes or insurance which is NOT what you want them to do! Make sure you read the fine print, and call (or write) your lender to confirm what they will do, or how you can assure that the extra money goes to reducing your principal balance.

Tip: Sending a separate check and clearly marking the “memo” field with your loan account and the phrase, “Apply to Principal”will help assure proper credit and provide strong documentation of your extra payments. Again, check with your lender.

Tip: Don’t bother with offers from your lender or 3rd party companies that offer to charge you money (often as much as $200-$300) to set up a bi-weekly payment program—you can accomplish the same thing yourself without their help—for free.

IMPORTANT NOTE: Although this is a great strategy to accomplish the twin goals of saving money and increasing equity in the capital asset that is your home, this may not be the best use of your financial resources.

Interest rates for home mortgages tend to be lower than most other consumer loans and your financial profile may suggest a better use for this money—like paying off higher interest consumer loans first.

Anytime you pre-pay extra money on any installment loan it has the same effect as investing your money at that interest rate. So if you had an extra $100 should you pre-pay it on a home loan at 6.5% or a consumer loan at 10%, for example? And don’t forget that mortgage interest is usually fully tax deductable, whereas other consumer interest is not.

Therefore, we recommend consulting a qualified financial advisor for a proper evaluation of your total financial picture before proceeding with this strategy.

(This money saving blog story was reproduced from the “Buyershome Journal” blog – April 12, 2007)

Last week, National City Bank announced that they will lay off 900 employees from their National City Mortgage division. National City has decided to shut down their wholesale mortgage department. The wholesale department was responsible for originating first and second mortgages with other mortgage brokers. National City will still originate  mortgages to the consumers through their branch office networks.

mortgages to the consumers through their branch office networks.

National City Bank is the the state of Ohio’s largest bank. The layoffs can be directly tied to the problems in the sub-prime mortgage crisis. This is another example of Banks “circling the wagons” and tightening credit options. As an Exclusive Buyer Agent I am actually more concerned with the trend of banks restricting or tightening credit options then with the layoffs. Tightening credit options & layoffs are both terrible for our economy. But, in my opinion, the bank management decisions to tighten credit and make it harder for the consumer to obtain mortgages will be a lot more detrimental to our economy and recovery in the long run. Contact me if you have any questions or if you are looking for a lender.

It has been a rough year for the real estate market & mortgage industry. But this week there was some good news, the US Congress extended legislation that makes mortgage insurance payments tax deductible until 2010. This legislation is one of the “bright spots” that will really help new and existing homebuyers for the next three years. Deducting the cost of mortgage insurance tax returns is expected to SAVE eligible borrowers $200 – $400 a year. The tax legislation, originally approved in December 2006, is basically the same expect for the three year extension. Borrowers whose annual adjusted gross income is $100,000 or less can fully deduct their mortgage insurance premiums from their 2007 – 2010 tax returns for homes purchased or refinanced during those time frames. Borrowers with incomes between $100,000 and $109,000 are eligible for a reduced tax break under the law. You can contact me if you further questions.

Below are some great links and a video that really help explain & understand mortgage insurance (MI) and last year’s tax legislation.

MarketWatch: Explaining The Tax Status of Mortgage Insurance

Wikipedia – Mortgage Insurance

News Story – One Step Closer To The American Dream!

Good Luck,

I’ve been receiving a lot of good information from experienced lenders that I trust. Everyone really needs to be aware of some drastic changes that will be occurring in 2008. The

I’ve been receiving a lot of good information from experienced lenders that I trust. Everyone really needs to be aware of some drastic changes that will be occurring in 2008. The

Cool Comments!